gadget

Things to consider when comparing gadget insurance

Does your policy protect you if your gadget is a refurbished model? With many trying to save money at the moment, refurbished electronics have become increasingly popular.

Read the article

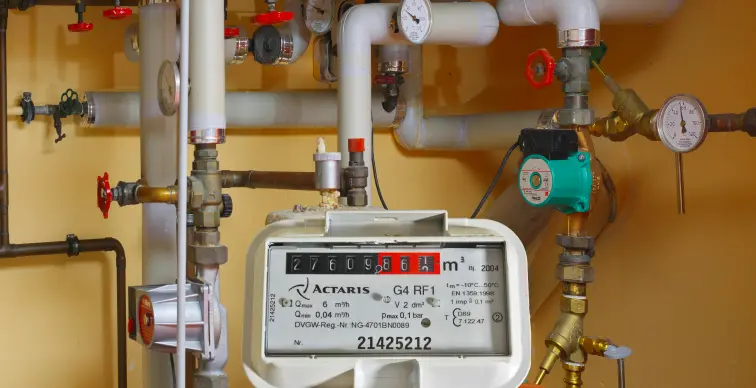

Boiler age

The age of your boiler is important. Some insurers won’t cover a boiler if it’s between seven – ten years old. Others stipulate that the boiler can’t be over 15 years. It’s believed that the older the boiler the more frequently it’ll break down and this cost won’t be covered by your premium.

Property condition

The condition of your house really matters. Insurers will take normal wear and tear into account but if you have neglected your property and not kept up with essential repairs, you may have a problem claiming for emergency cover.

Conventional house insurance v home emergency and boiler cover

Not all standard house buildings and contents insurance policies will cover emergencies, or you may find that you’ll have to pay a hefty excess if this option is included in your policy. With emergency home insurance/boiler cover in place, there’s no limit to the number of claims you might need to make during the term of the policy. A standard annual premium is all you’ll have to pay to ensure you’re protected against all emergencies.

Exclusions

Always read the small print when taking out this type of insurance. A home that’s been empty for over thirty days and suffered damage won’t be protected. If an emergency happens within the first 14 days of the policy starting, you may have difficulty making a claim. Sometimes it can be tricky to make a claim should your boiler fail over the course of the summer – the Ts & Cs will clarify whether this applies to just heating or includes access to hot water.

Comprehensive Annual Service

One unique factor to consider is whether the boiler cover policy includes a comprehensive annual service. An annual service not only ensures your boiler runs efficiently but also helps identify potential issues before they become costly repairs. Look for policies that provide a thorough service, including checks for gas leaks, efficiency optimization, and safety inspections, as this can save money and prolong the life of your boiler.

24/7 Emergency Support and Response Time

Not all boiler cover policies are equal in terms of customer support. Consider the availability of 24/7 emergency support and the average response time for service calls. Boilers can fail at inconvenient times, and quick access to professional help is crucial. Ensure the insurer offers prompt response times and has a network of certified engineers who can attend to emergencies swiftly, minimizing inconvenience and potential damage.

No-Claims Discount

Some boiler cover insurance providers offer a no-claims discount, rewarding you with lower premiums if you don’t make any claims within a certain period. This can significantly reduce your overall costs over time. Investigate if the insurer provides this incentive and how it works, as it can be a great way to keep your insurance affordable while maintaining coverage.

Coverage for Boiler Replacement

While most boiler cover policies focus on repairs, consider whether the policy includes coverage for boiler replacement if it’s deemed beyond economical repair. Boilers have a finite lifespan, and replacing them can be expensive. A policy that contributes to the cost of a new boiler, either partially or fully, can offer substantial long-term savings and peace of mind.

Inclusion of Central Heating System Components

Boiler issues can sometimes be related to the broader central heating system. Ensure your boiler cover policy includes components of the central heating system, such as radiators, thermostats, and pipes. Comprehensive coverage means that related issues are addressed, reducing the risk of being left without heating due to an uncovered component failure. This holistic approach ensures your entire heating system is protected and maintained.

By focusing on these unique considerations, you can choose a boiler cover policy that not only protects your boiler but also provides additional value, savings, and peace of mind.

gadget

Does your policy protect you if your gadget is a refurbished model? With many trying to save money at the moment, refurbished electronics have become increasingly popular.

Read the article

travel

Covering medical expenses overseas can prove very costly, Travel insurance will provide cover so that these expenses can be made.

Read the article

pet

Pet insurance is not compulsory. However, it can be useful to have if something unexpected happens to your pet. In this article we will give an outline of what pet insurance is, what it covers and explore some of the reasons why it is important. We hope this will give you enough information to decide whether pet insurance is a worthwhile investment for you and your furry friend.

Read the article

pet

When you have a pet, they are truly a part of the family. When a pet falls ill, you will naturally want to ensure they can get the best care possible. However, it is no secret that vet visits can be expensive. Pet insurance is a worthwhile investment to ensure you can give your pet the treatment they need at times they fall under the weather.

Read the article